Support Blog

How to open bKash merchant account for FREE 2024

Table of Contents

To open a bKash merchant account in Bangladesh for Free, you’ll need to follow a set of procedures and meet certain requirements. A bKash merchant account allows businesses to receive payments from customers via the bKash mobile payment system. Here are the steps to how to open bKash merchant account:

- Business Registration: Ensure that your business is legally registered and operational in Bangladesh. You should have all the necessary licenses and permits required for your type of business.

- Bank Account: Open a bank account in a registered bank in Bangladesh in the name of your business. This bank account will be linked to your bKash merchant account for fund settlement.

- Prepare Necessary Documents: Gather the following documents for A bKash merchant account allows businesses to receive payments from customers via the bKash mobile payment system. Here are the steps to how to open bKash merchant account.

- National ID of the owner/proprietor/partners/directors.

- TIN Certificate of the business entity.

- Trade License.

- Bank account details (name of the bank, branch, account number, etc.).

- Passport-sized photographs of the owner/proprietor/partners/directors.

- Visit bKash Office or Agent Point: You’ll need to visit a bKash office or authorized agent point with all the required documents. At the bKash office or agent point, you can request an application form for a A bKash merchant account allows businesses to receive payments from customers via the bKash mobile payment system. Here are the steps to how to open bKash merchant account.

- Complete Application Form: Fill out the application form with accurate information about your business and personal details. Attach the necessary documents as per the requirements mentioned in the form.

- Submit Application: Submit the filled application form along with the required documents to the bKash office or agent. They will verify the information and documents.

- Verification: bKash will review your application and documents. This may take some time for approval, and they may contact you for additional information if needed.

- Agreement Signing: Once your application is approved, you’ll be required to sign an agreement with bKash outlining the terms and conditions of the merchant account.

- Training: You may be required to attend a training session to understand how to use the bKash merchant system.

- Activation: After all the necessary steps are completed, your bKash merchant account will be activated, and you’ll receive details on how to use it for accepting payments.

- Start Accepting Payments: You can now start accepting payments from customers via bKash. You’ll receive settlement in your linked bank account.

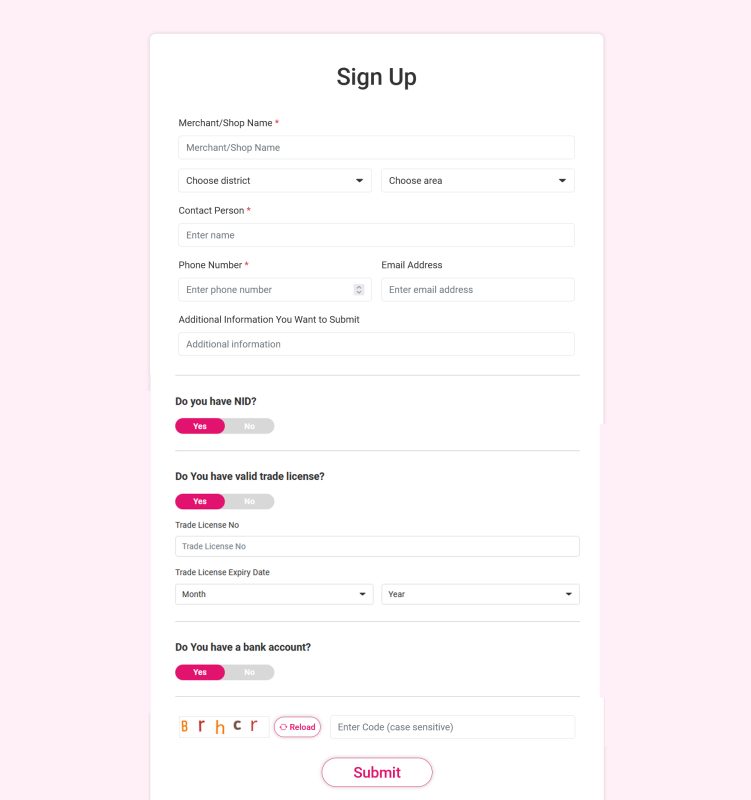

To complete the how to open bKash Merchant Account application form, you’ll need to provide the following details as outlined below:

- Business Name: Indicate your business name or any associated name for your establishment.

- Website Address (if applicable): If your business operates a website or conducts e-commerce, you can provide the web address, though this is optional.

- Office Address: Specify the primary location of your business. Ensure accuracy, as a bKash agent may visit your office for verification.

- Type of Business: Describe your business type and the services you offer.

- Current Business Address: Provide your current business location, being cautious to enter the correct address.

- Estimated Monthly Collection: Offer an approximate monthly payment collection amount.

- Applicant’s Name: If you’re the account holder, state your name.

- Contact Number: Supply a reachable contact number for communication.

- Photo ID Number: Share the number from your National ID Card, Smart ID, Passport, or Driver’s License.

- Trade License Number and Validity: You must have a valid trade license; provide the license number.

- Email Address: Include your email address, which is a mandatory requirement.

- Complete the Captcha: Solve the presented captcha (e.g., a simple math question).

- Submit: Locate the “Submit” or “Submit Your Form” option at the bottom and click to submit your form.

Upon submission, the bKash authority will review your application. If approved, they’ll provide initial confirmation and request you to visit the nearest bKash Merchant Office. Bring the prescribed form and specified documents for in-person verification. After discussions and verification, your bKash merchant account will be activated.

Requirements for opening a bKash merchant account:

- Mobile phone or smartphone from any operator.

- National ID card with a photocopy (or other valid ID like Passport/Driver’s License).

- Two colored passport-sized photos.

- Valid trade license for your establishment.

- Active personal or institutional bank account.

- Tax Identification Number (TIN) or e-TIN.

- Printed copy of the completed form from the bKash website.

bKash Merchant Account Transaction Charges and Limits:

- Cash-out charge for bKash merchant account: 1.70%

- No transaction limits or restrictions; transactions can start from BDT 1 without a maximum limit.

- Slightly lower cash-out charges compared to personal accounts.

bKash Merchant Account Benefits:

- No limits on the number of merchant accounts; you can open multiple accounts with the same ID.

- No transaction limits; you can perform transactions starting from BDT 1.

- Ability to create and promote offers for your business.

- Direct fund withdrawal to your bank account.

- Receive payments through your website and app via the bKash payment gateway.

Disadvantages of bKash Merchant Accounts:

- Can only receive payments from personal accounts and personal retail accounts.

- No immediate cash-out; funds are withdrawn through bank transfers.

- It will charge 1.25% for transferring the bank account.

bKash Offer you will get from our gift shop online in Bangladesh from order.

Please note that this information is based on available sources, and it’s essential to refer to the official bKash website for the most accurate and up-to-date instructions and forms. Authorities may implement changes, modifications, or errors in the information. For urgent and precise information, always refer to the official website. This information is for reference purposes and not a substitute for official guidance.

Keep in mind that the specific requirements and procedures may vary over time, so it’s advisable to check the latest guidelines on the official bKash website or contact their customer support for the most up-to-date information. Additionally, you may want to consult with a financial advisor or representative from bKash for personalized assistance with the application process.